| Canada Bank reduces prices to 25 points

Canada Bank (BOC) reduced the reference interest rate at 25 basic points to 2.75 %, as expected – this was the seventh consecutive reduction – and warned of a “new crisis” due to the effects of the American customs tariff on the Canadian economy. BOC added that it “will carefully move to any other changes” of the fees, given the need to assess rising pressure on inflation, caused by high costs, such as the dumping pressures resulting from poor demand. Tif Maclim, BOC ruler, said that Canada is facing a new crisis, depending on the extent and duration of the new American definitions, the economic impact may be dangerous, with uncertainty that already causes damage.

At the value of EUR/CAD last week, after a new maximum renewed on July 31, 2020, for 1.5856 Canadian dollars. After renewing such a maximum, the husband has a little corrected, however, quotes his support of $ 1.51 and his 200 -day mobile medium, which is currently $ 1.4949. The EUR/CAD MACD index maintains an open pair purchase sign.

| USA: inflation below expected

The American symmetric inflation decreased to 2.8 % in February, less than 2.9 % of the expected in the market and 3 % registered in January. In the chain, the inflation was 0.2 %, also less than 0.3 % expected. Readings were partially expected due to a 4 % decrease in the air definition chain. The basic inflation, which excludes food and energy products, was 3.1 % in February, less than 3.2 % expected and 3.3 % registered in January. This has been the first time since July that it reduces inflation and basic inflation simultaneously. On the other hand, the prices of American producers remained unchanged in February, unlike 0.3 % increase after an increase of 0.6 % in January. In terms of annual, the PPI price index slowed to 3.2 %, less than 3.7 % in January. The market is now 97 % probability for federal reserve prices at a meeting next week.

EUR/USD started the week with a strong climb, which resulted in the renovation of the maximum October 2024 at $ 1.0947 and is close to its resistance at $ 1.10. The dollar was recovered at the end of the week, with the European session closed on Friday less than $ 1.09. The MACD index maintains an open purchase signal.

| The price of oil is stable

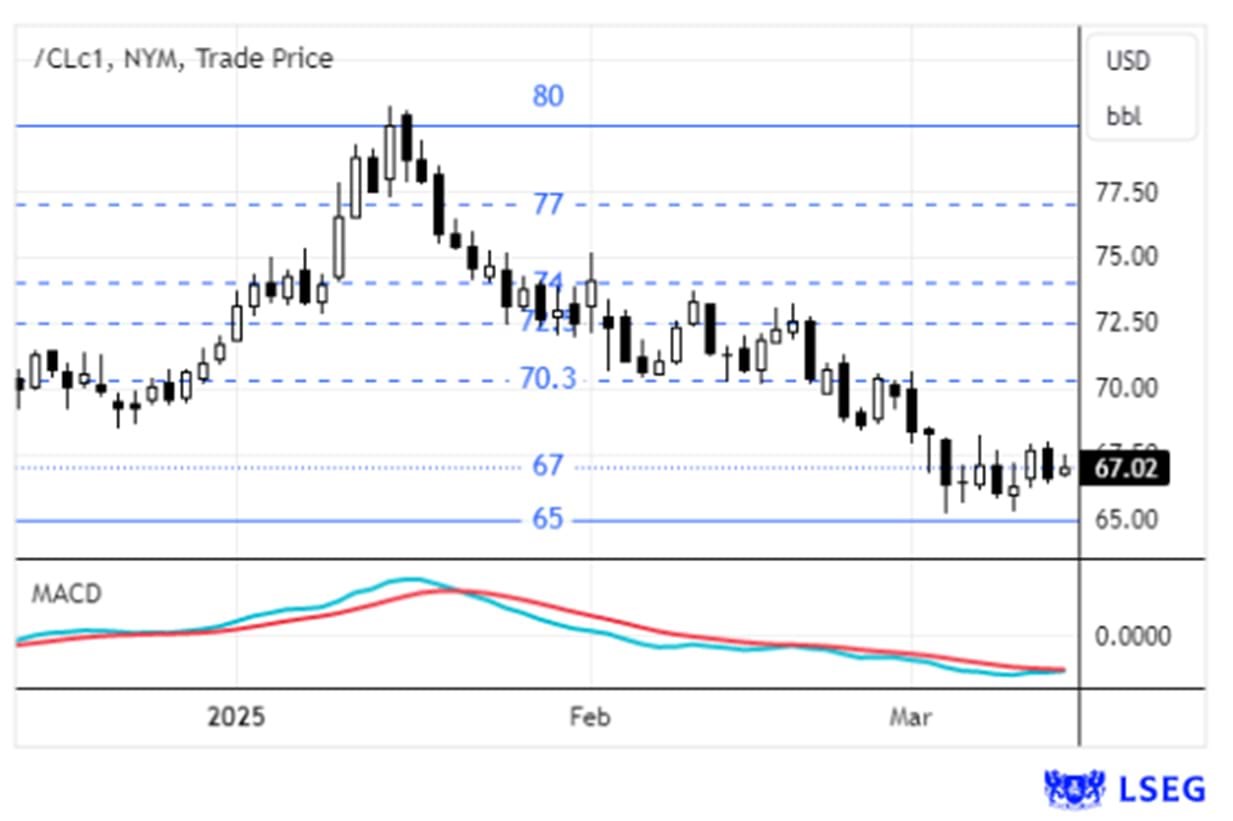

The price of oil remained stable last week. Despite the possibilities of increasing production by OPEC+ and the annual rough imports through China, reducing the value of the dollar contributed to maintaining the market.

Raw side, maintaining the highest support at $ 65/barrel. During the week, the price of raw materials ranged between $ 65.29 to $ 67.94 a barrel.

| Gold over $ 3000/Jaguar

Gold went over the past week, after exceeding $ 3,000/Jaguar for the first time. This climb took place in the context of global uncertainty, driven by tariffs and geopolitical tensions, as well as fear of potential stagnation in the United States.

After finishing the previous week about 2900 dollars/Jaguar, Gold started the week with a strong grade, after renewing a new maximum for $ 3004.86/jaguar. After renewing such a maximum, gold again negotiates a little less than $ 3000/Jaguar.

Technical analyzes published here is not, in any case, to be advice or recommendation to buy and sell financial tools, so analysts and business magazine cannot be responsible for any losses or damages that may result from the use of this information. If you want to see any questions about technical analysis, please contact the International Monetary Fund or Business magazine.