Many investors have been trained to renew mood with the encryption market this week. This happened in the wake of the US Federal Committee meeting in the United States on Wednesday (19), which was positively received by the market and led to Bitcoin’s assessments and some altcoins.

In a more moderate speech, Jerome Powell showed that the Federal Reserve Bank is ready to make its position more flexible, indicating a satisfaction in the cash tightening.

One of the prominent points was the decision to reduce the sale of assets from its balance of $ 25 billion to $ 5 billion.

- The easy and safe way to invest in encryption. In mynt, it negotiates a few clicks and with the safety of BTG Pacual. Buy the largest encryption in the world in minutes directly through the application. Click here to open your free account.

This measure reduces liquidity drainage in the financial market – which means, in practice, more capital available to risk assets, such as hidden. Simply put, when the Federal Reserve sells less active, there is less sales pressure on securities, which maintains low income and encourages investors to search for greater returns than the most volatile assets.

Another important point of speech was to admit that Trump’s trade war could lead to low growth and high inflation. Even in the face of this scenario, the decision was to maintain the estimate of two discounts in benefits until 2025. This indicates that the US Central Bank is ready for economic consequences, indicating willingness to motivate the economy if necessary.

- Free: Discover the 3 best investment strategies in Bitcoin

Want to know how to invest in encryption? Knowing the strategies recommended by experts!

All this helped reduce noise and show a possibility of the market to cross the total economic storm.

However, the feeling of the chipposphleer ambassador remains in the scope of fear, as the rate of fear and greed indicates.

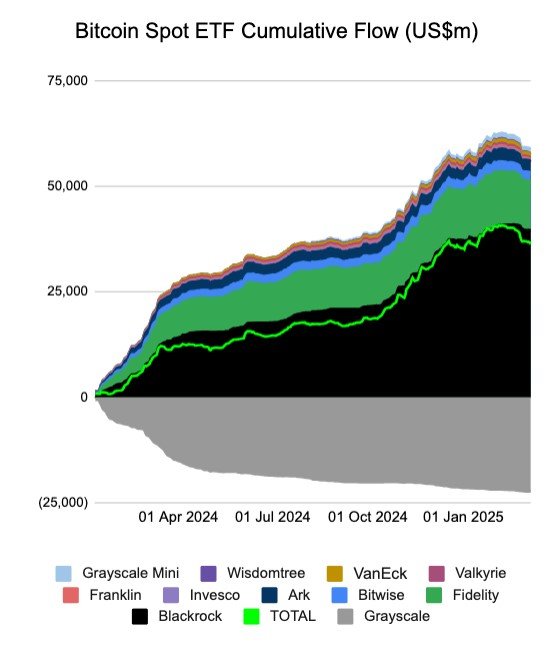

Despite the fear of retailing with Trump’s government policies, Bitcoin mainly maintains the high direction and big players are still accumulating – monitoring the graph below the cumulative flow of the Etfs Bitcoin spot, the main institutional money entry channel in the encryption market.

The question that fits here is: What stimulates the difference in the position between retail and institutions?

Let’s investigate.

Retail investors

The current dynamics of Cryptoesosphere are strongly affected by the way in which retailers act. In general, a much more emotional reaction appears more than price differences – this may be expensive.

Why does this happen? Some of the main factors:

Short -term mindset

Anxiety about instant results is one of the largest enemies of the ordinary investor. While institutions invest in planning with contracts prospects, retail seeks that the miracle process that will turn $ 100 to one million dollars to a week.

What does not tell you? These stories of enrichment overnight on social networks, such as making millions with memecoins that rose 1000 % in one day, hides that 95 % of these projects fail in months.

What you can do to combat short -term mental:

Change the motivation for a strategy

Start by setting clear financial goals for 3, 5 and 10 years, for example. Thus, when the motivation begins to speak higher, reconsider the strategy. Instead of putting your money on metal currencies, your direction will be to search for a varied wallet with more solid work taking into account a wider horizon.

See the basics, not just the price

Mimokinat that deserves cents can be good to speculate, but speculation requires knowledge and experience. If you are coming now, focus on studying the proposal, technology, project capabilities, and adopting asset. Projects without real use or without a strong investor base tend to disappear quickly.

Make DCA

Resisting the timing of the market timing, trying to predict the best time to buy. I always recommend an average cost in dollar (DCA), a proven efficiency method that would reduce the pressure of the purchase decision. The idea is to make investments at regular intervals regardless of the price. This reduces the risk of volatility and avoids unfavorable purchases in the peaks.

Understand market courses

The cryptocurrency passes through natural and low courses, and understanding that this will change the way they behave in the face of fluctuations. If the investment thesis is still valid, short -term corrections (such as those we live now) are actually buying opportunities.

The fact that we are on the emerging market does not mean that the prices will climb without stopping. The settlements are a healthy part of the process. At this stage, the market is in a stage of accumulation and the signal correction that in the last climb cycle, we saw a decrease of up to 30 % before the new assessments.

Pisces manipulation

The “whales”, as the great Crypto holders are called their financial strength to create fear and imbalance in the market. With interest, it can cause a sudden decrease in its price by selling large amounts of assets at the same time, generating the feeling that the crisis has started.

The result? Young investors panic and sell everything for fear of losing more money. The whales, on the other hand, seize the opportunity to purchase assets at much lower prices. In this manipulation, they can still publish news and rumors in the media or social networks to deepen the psychological game.

Lack of knowledge

Ignorance is expensive. The study is Marco Zero for any entry into a volatile and volatile market like encryption.

Today, there is a lot of good and free content on the Internet, but often no one can begin to distinguish between what should be taken seriously – or not. It is clear that these contents are not replaced by tasks that are indispensable for investment safely, such as white analysis, the study of the symbolic economy deeply, and the understanding of how to use the available standards.

The lack of financial education is, in fact, the abyss that separates the retail sale from the institutions. Let’s understand their point of view now.

Institutional investors

Those who follow the market witnessed the mobilization of large institutions and even governments to pump their bets on digital assets.

This week’s Coinbase Survey with Ey-Parthenon this week explains the institution’s increasing enthusiasm: 83 % intend to increase exposure to encrypted currencies by 2025.

What they understood:

This Bitcoin scarcity is a fundamental advantage that pays the value of the currency. The maximum Bitcoin providing 21 million units – this means that more coins will not be created upon reaching this goal. Adult players know this and accumulate, and expect future appreciation.

It is in complex scenarios, news is an excellent opportunity to diversify the portfolio. It can act as protection against inflation and other economics.

To provide Blockchain technology and decentralized protocols, with solutions like Defi, shows the strong ability of the encryption market to adaptation and innovation, and build a strong foundation for long -term sustainable growth.

Many countries (like the United States) wake up – and many will wake up – to the importance of Bitcoin and other digital assets in their reserves, which contributes to legitimacy to the stability and increase of Cryptoesosphere.

What is the lesson we take from all this? While the retail sale discusses risks, institutions browse uncertainty while observing opportunities. On what side do you choose to be?

Follow the future of money on social networks: Instagram | x | YouTube | cable | Tick