European scholarships increase with Trump to suggest the resource of customs rights to electronic products

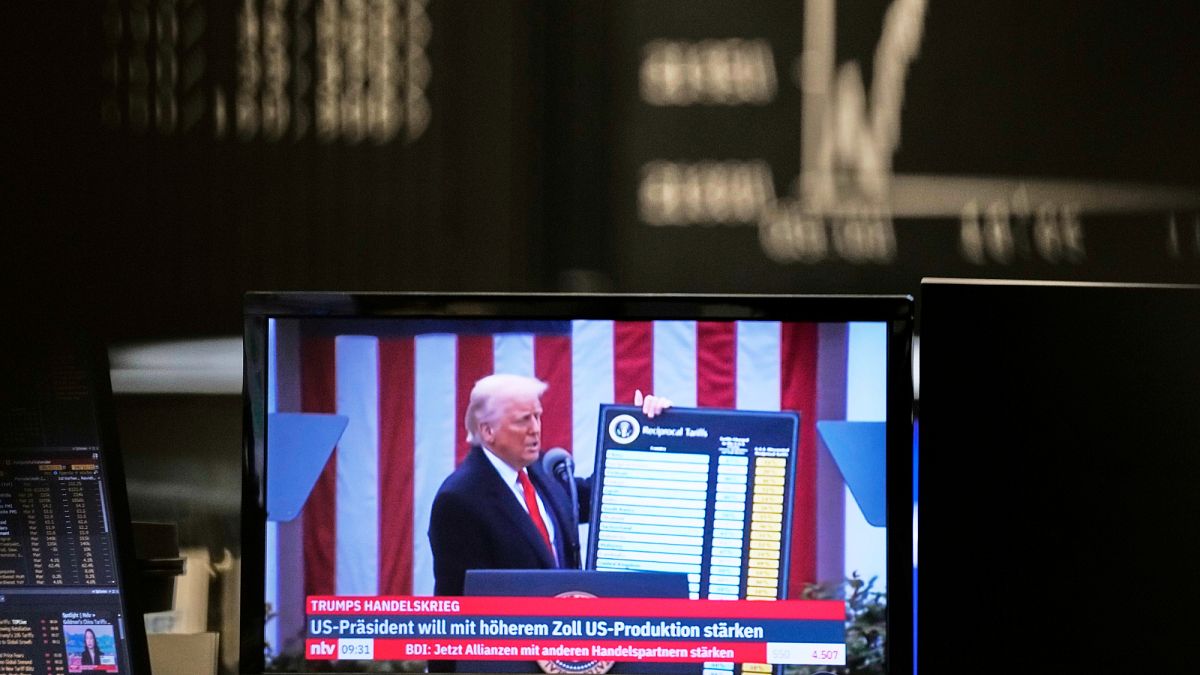

The euro has increased its profits from the US dollar, while European scholarship markets are ready to open after the White House has exempted electronic products from its reciprocal tariffs. However, the president of the United States, Donald Trump, and his administration suggested that the exemption can be of short duration, stating that tariffs resume after “national security rate investigations”, adding more uncertainty to an already volatile business environment.

On Sunday, Trump insisted that an exemption of rates had not been granted, although on Friday the customs and border protection of the United States have not been awarded that electronic devices, including smartphones, computers and other components, were exempt from tariffs: 145% on the imports of China and 10% over other countries. The White House confirmed the exemptions on Saturday.

The China Ministry of Commerce has reacted to the United States’s decision on electronic products, classifying it as “a small step” to correct the unfair imposition of unilateral reciprocal customs rights by the United States. The spokesman declared: “We exhort the US part to take into account the rational voices of the international community and several national sectors, to take an important step to correct their errors, completely abandoning the erroneous practice of” reciprocal customs “and return to the correct form of mutual respect and the resolution of differences through an equitable dialogue.

“No one is free for unfair commercial scales, especially China, who, with much, treats us worse!” Trump wrote about Truth Social on Sunday. “An exception of rate was not announced on Friday,” he added, while indicating that the administration was “analyzing the semiconductors and the entire electronics supply chain” as part of the next investigations of national security rates. He also confirmed that electronic products would be subject to 20% of Fentanile rates, stating that “they are moving to a ‘cube’ of different rates.” False News know it, but deny to inform. “

The United States Secretary of Commerce, Howard Lutnick, also confirmed during an interview with ABC News on Sunday that “non -permanent” exemptions and new tariffs will probably arrive within one or two months. “

European markets open with the improvement of feeling

European markets should open, even with Trump suggesting a reversal of tariffs in the near future. From 5:00 on Monday in Central Europe, future actions were widely positive, with the Euro Stoxx 50 increasing 2.5%, Germany Dax increased 2.28%and the FTSE 100 of the United Kingdom won 2.01%.

The euro also increased from the US dollar, with the dollar prolonging its weakness in a context of additional economic uncertainty. The EUR/USD pair rose above 1.04 before retiring slightly during the beginning of the Asian session.

In the US, the future of actions increased at the beginning of Monday’s negotiations after the weekend’s political developments. Nasdaq Composite, High -Tech, Rose 1.3%, S&P 500 won 0.85% and Dow Jones Industrial Averaga increased 0.24% of 5:05 in central Europe, less an hour in Lisbon.

Technological actions in the United States are expected to focus since the sector was one of the most affected by Trump’s reciprocal rates. Apple, in particular, had one of the worst performances before the recent market recovery, falling 22% before the historical recovery last Wednesday, when Trump announced 90 -day rates in rates. With much of its China -based production, Apple is especially vulnerable to import rates, and analysts had warned about significant pressure on the company’s profit margins. The exemption of electronic products can serve as a catalyst for a short -term recovery of Apple’s actions.

Asian markets recover, led by Hang Seng’s profits

Asian markets also registered profits, with the HANG Seng index of Hong Kong leading the climb. The index increased 2.42% of 5:20 in Central Europe, after China registered an annual 12% increase in exports last month. However, analysts believe that the increase can reflect the anticipation of exports by exporters, who try to exceed the deadline for new tariffs, which increases the concerns of potential deceleration in the coming months.

Other important regional indices have also advanced. Nikkei 225 of Japan increased 1.85%, Australia ASX 200 increased 1.52%, and South Korea Kospi won 0.76%in the same period.